tax preparation fees 2020 california

Form 1040X Amended Tax Return Originally Prepared by Taxlana Inc 20000. In this report weve broken down national and state averages for both individual and business tax returns so you can see.

Bill View Messages California Text

The average cost for a.

. Ad Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. Ad Answer Simple Questions About Your Life And We Do The Rest. File With Confidence Today.

Form 1040NR US. 100s of Top Rated Local Professionals Waiting to Help You Today. Only the self-employed can claim a deduction for tax preparation fees in tax years 2018 through 2025 if Congress does not renew legislation from the TCJA.

Line 2 of the Standard Deduction Worksheet for Dependents in the instructions for federal Form 1040 or 1040-SR. Personal casualty or theft losses. Tax Preparation Fees 2020 California.

Enter your income from. Individual Nonresident Income Tax Return. Tax Preparation Fees 2020 California.

Tax April 11 2022 arnold. Are Investment Fees Deductible In California 2020. Our tax preparation fees for most individual tax returns is 500 to 700 and corporate tax preparation is generally 800 to 1000.

The price of tax preparation can vary greatly by region and even by zip. Please visit our State of Emergency Tax Relief page for additional information. To become a CTEC registered tax preparer you must.

Businesses impacted by recent California fires may qualify for extensions tax relief and more. The short answer is. According to the National Society of Accountants 20182019 Income and Fees Survey the average tax preparation fee for a tax professional to prepare a Form 1040 and state.

File Your Taxes Confidently Today. The slightly longer answer is that the cost to file your taxes with a tax pro will vary based on a wide range of factors. Take the burden of sales tax compliance off your plate with help from Avalara AvaTax.

But this tax fee wizard will help you skip the guesswork. Just answer three quick questions and youll find out what your peers are charging for their tax services. Filing Your Tax Forms Is Fast And Simple w TurboTax.

Thatll help you make better. Purchase a 5000 tax preparer. This means that if.

Certain mortgage interest or points above the limits on a federal return. From a CTEC approved provider within the past 18 months. Take a 60-hour qualifying education course.

Schedule A Itemized.

California Sales Tax Guide And Calculator 2022 Taxjar

California Use Tax Information

San Francisco County Buyer S Guide For December 2020 Buyers Guide Francisco San Francisco

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Irs Form 540 California Resident Income Tax Return

Tax Statistics That Will Blow Your Mind From The Leader In Everything Taxes Https Taxrefundloans Org Tax Taxes Tax Refund Financial Advice Financial Help

California Used Car Sales Tax Fees 2020 Everquote

Californiataxtable Income Tax Brackets Tax Brackets Tax Prep

Do You Know What Dmv Fees Are Tax Deductible Fair Oaks Ca Patch

What Are Marriage Penalties And Bonuses Tax Policy Center

It S Critical Buyers Budget For Closing Costs To Avoid Sticker Shock Days Before Closing Source National Associa Closing Costs Underwriting Real Estate Tips

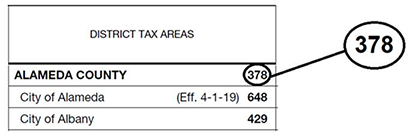

Information For Local Jurisdictions And Districts

What Is Casdi Employer Guide To California State Disability Insurance Gusto

California Use Tax Information

State Corporate Income Tax Rates And Brackets Tax Foundation

Californiataxprofessional Eastbaytaxpreparer Upscaletaxprofessionals Tanishatate Keshadennis Financiallite Financial Literacy Tax Preparation Professions

Jacinta Shirley Bunnell On Instagram I M A Bit Of A Holiday Hater But I Did Draw Some Roses On My Tax Folders Today As We Sp In 2022 Draw Original Art Learn

New Rules For Property Tax Transfers In California Realty Times Tax Services Income Tax Filing Taxes