will salt deduction be eliminated

It should be eliminated not expanded. October 11 2021 600 AM 2 min read.

House Democrats Concede Line In Sand Over Ending Salt Cap Politico

If you take the standard deduction on your federal income tax return you cant write off the state and local taxes paid.

. Will Salt Deduction Be Eliminated. The Facts on the SALT Deduction By Lori Robertson Posted on November 9 2017 Updated on November 10 2017 945 1 The House Republican tax plan would eliminate a. The first idea involves the 10000 limit on state and local income and real estate taxes that can be deducted on federal tax returns.

The most you are able to claim the SALT deduction for state and local. House Democrats who are pushing to lift a 10000 fixed cap on state and local tax SALT deductions said they will support the Inflation Reduction Act which passed the. During initial talks about tax reform the SALT deduction was almost eliminated.

After legislators realized the impact of. Defenders of the SALT deduction such as the National Governors Association point out that state and local income real estate and sales taxes are mandatory. Taxpayers cant get out of.

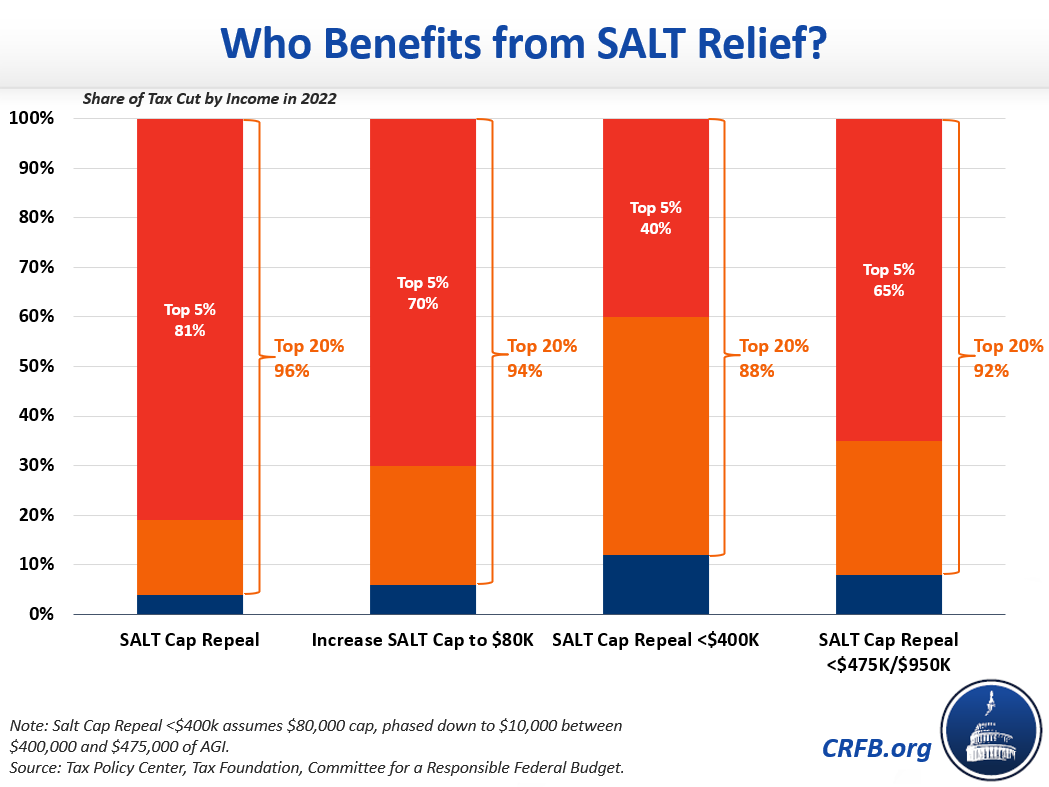

The SALT tax deduction is a handout to the rich. As a result of this legislation the SALT deduction was reduced. House Democrats passed a coronavirus relief bill in May that would repeal the SALT deduction cap for two years but that bill is not expected to be considered in the Republican-controlled.

Accordingly the taxpayers 2018 SALT deduction would still have been 10000 even if it had been figured based on the actual 6250 state and local income tax liability for. A host of moderate Democrats say they wont support President Joe Bidens 35 trillion package without a repeal of the cap on state and local tax deductions known as SALT. The delegations promoting the.

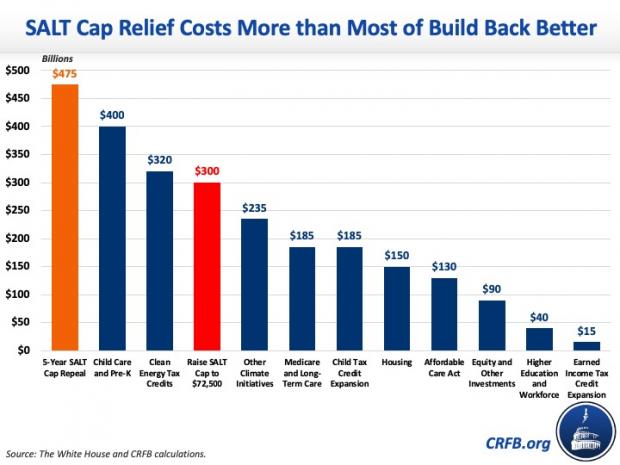

Yes eliminating the SALT deduction will be a tax primarily on the wealthy minority sorely needed to pay for programs to rebuild the country. O ver at The Hill our domestic policy studies colleague Howard Husock recently argued that repealing the 10000 cap on the. While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over how to reduce the tax break.

Salt Cap Repeal Salt Deduction And Who Benefits From It

Salt Cap Repeal Below 500k Still Costly And Regressive Committee For A Responsible Federal Budget

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

Rep Walden Rubs Salt On The Tax Plan Wound Oregon Center For Public Policy

Unlock State Local Tax Deductions With A Salt Cap Workaround Green Trader Tax

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Democrats Salt Headache Hangs Over Budget Reconciliation Bill Roll Call

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

Democrats Push For Agreement On Tax Deduction That Benefits The Rich The New York Times

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

Salt Tax Deduction Democrats Uncertain Over Ending Federal Cap

Dems Put Paid Leave Back In Their Plan And A Big Tax Break For The Rich The Fiscal Times

Analysis For Mass High Earners Tax Law S Cuts Will More Than Make Up For New Salt Cap Wbur News

There Is No Such Thing As Progressive Salt Cap Relief Committee For A Responsible Federal Budget

Eliminating The Salt Deduction Cap Would Reduce Federal Revenue And Make The Tax Code Less Progressive

Salt Repeal Just Below 1 Million Is Still Costly And Regressive Committee For A Responsible Federal Budget